6 Things That Hurt Your Credit Score

Credit Education , Credit ScoreRentReporters

March 15, 2021

8 mins read

Your credit score plays a big part in your life. Not only does it affect the interest rates you pay when buying a house or car, but it can also affect the deposit you pay when renting, your insurance premiums, and even your job applications.

Your credit score matters so you need to know how to take care of it. Here are 6 things that hurt your credit score.

1. Lack Of Credit History

This is the classic credit score catch 22 – you build credit with credit cards and loans, but you need to have a credit score to get approved for a credit card or loan. No or low credit history means a low credit score.

But did you know that lenders dont look at just your credit score? They’ll also look at your entire credit report which is far more detailed than just your score.

You can use RentReporters to report your rent payments to the credit bureaus to build both your credit history and credit score. You can also use products like Experian Boost which add your subscriptions, utilities, and cell phone bills to your credit history. Both are great ways to build your credit history and give you a big boost to your score.

2. Errors In Your Credit Report

An FTC study found that 25% of consumers had an error in their credit report from one or multiple credit reporting agencies.

Errors are sometimes caused by simple human mistakes, but unfortunately, they can also be from fraud. When a fraudster gets a hold of your information, opens up a credit card or loan in your name, spends the money and does not repay the debt, this shows up on your credit report as a delinquent account and really hurts your credit score.

It’s a good idea to keep a close eye on your credit report and look out for anything you don’t recognize like unexpected charges on your cards or new accounts you did not open.

If you find something, be sure to contact the company on your credit report to let them know. Then contact the credit bureaus to let them know there is a mistake and potential fraud on your account.

It’s also not a bad idea to freeze your credit.

3. You Made A Late Payment

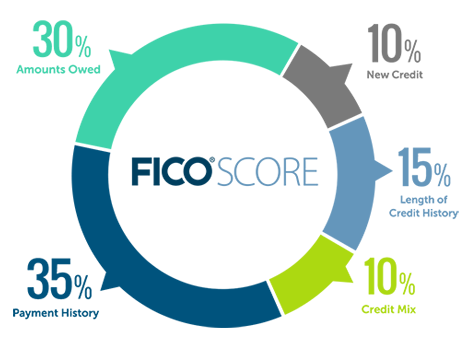

On time payments are the most important factor in your credit score. A single late payment can significantly ding your credit score.

Be sure to make payments on time. Try setting up automatic payments on your bills and credit cards and always pay at least the minimum payment on your credit card by the due date. If you can, pay off the statement balance in full by the due date so you don’t get charged interest.

4. Applying For Too Many Credit Cards & Loans In A Short Period Of Time

Every time you apply for credit, a hard inquiry appears on your report. These typically only affect your credit score by a few points and after a couple of months your score should go back up.

While the impact on your score may only last for a couple months, the inquiry itself remains on your report for up to two years.

Having too many hard inquiries on your credit report in a short period of time makes the credit agencies question why you need to open so many new accounts. This means you can be viewed as a credit risk and can potentially hurt your score.

Be sure to apply for credit when you really need it.

5. You Closed An Account

If you pay off a card and close it, you could significantly hurt your score in a few ways.

First, that account no longer counts towards your average credit age. For example, if you have two cards with one being ten years old and the other brand new, then your average credit age is five years. To calculate this, you take the total credit age of all of your accounts and divide by the number of accounts.

If you close your ten year old account, now your average credit age is less than one month.

Next, your total available credit decreases which affects your debt to credit ratio. Using the same example, if your ten year old card has a $5,000 limit and your new card has a $3,000 limit, your total available credit is $8,000.

If you typically have a $1,000 balance, you have a 12.5% debt to credit ratio, which is good. Lenders like to see that you’re not maxing out your credit, so staying under 30% is considered a good ratio.

If you cancel your old card, now your total credit is only $3,000. That same $1,000 balance is now 33% of your total credit. Now your ratio looks a little high and your score will drop.

Take Our FREE Credit Literacy Quiz!

In just a few minutes, discover your credit knowledge level and get instant access to a FREE credit education course tailored to you!

6. You Opened A New Account

Wait a minute, your score goes down when you close an account and open a new one?

Yes but opening an account is usually a smaller dip that recovers quickly.

When you open the account your score drops because of the hard inquiry we talked about earlier and also because it’s brand new, it lowers your average credit age.

On the other hand, your total credit goes up which positively affects your debt to credit ratio, which is why the dip in your score is typically smaller.

With time the account becomes more mature and as you continue to make on time payments, your credit score will go up.

Nurture Your Credit Score & Take Advantage Of Rewards

Hopefully now you have a better understanding of what affects your score and are better prepared to manage your credit. To recap, here are the 6 things that hurt your credit score:

- Lack Of Credit History

- Errors On Your Credit Report

- Late Payments

- Applying For Too Many Loans & Credit Cards In A Short Period Of Time

- You Closed An Account

- You Opened An Account

Once you’ve mastered how to manage your credit score, you can take advantage of rewards cards that offer valuable cash back and perks. A higher credit score will allow you to save hundreds, even thousands of dollars on a car, a home, personal loans, insurance products, and can even boost your chances of getting hired.

Your credit score matters so make sure you take care of it!