How to Save Thousands of Dollars on Your Car Loan

RentReporters CommunityRentReporters

December 7, 2016

5 mins read

Despite the amount of press coverage around the popularity of auto ride sharing services, most US households still want a car of their own – even young adults or millennials. With 84% of new cars purchased with financing, people are borrowing more than ever. Between 2014 and 2015, total auto loan debt in the US grew from almost $900 billion to $1.1 trillion, with the average auto loan at almost $28,000 and a monthly payment of over $450.

Yet if you don’t have a good credit score, it’s hard to qualify for any loan, much less one with a competitive interest rate that gives you a monthly payment you can afford.

If you are one of the more than 100M renters in the US (41% of households) who do not have the advantage of a home mortgage as a tradeline on your credit report, you may have a lower credit score than you deserve – even if you have consistently paid all of your financial obligations. This is also a problem if you are one of the recent college graduates dutifully making monthly payments on an average of nearly $49,000 in student loan debt. The same is true if you are among the 45M people who have no credit score and have had to conduct most of your ongoing transactions via cash.

It doesn’t seem right that someone who pays their debts on time would have a lower credit score in these situations. And that lower score definitely translates to the financial bottom line when you want to make a car purchase.

Increase in Credit Score Drives Car Loan Savings

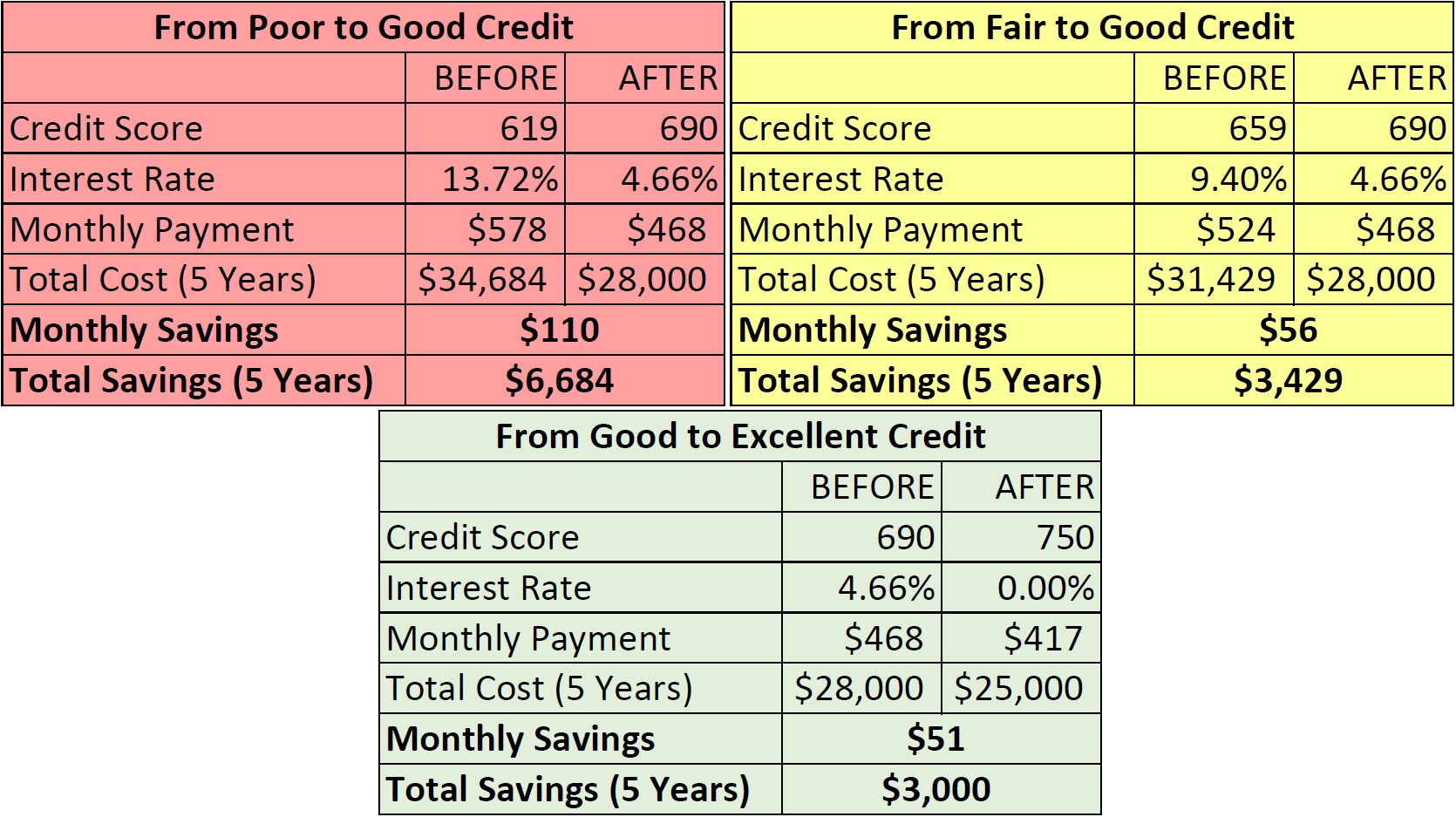

Let’s look at the financial savings in three car loan scenarios that would result if you could increase your credit score by as little as 31 points. (Details are included in the table.)

This example assumes a $25,000 loan paid over 5 years. Here is what happens when you increase your credit score:

(1) From Fair to Good: If you could increase your score by 31 points, your interest rate would be cut in half, saving you $3500 over the life of the loan.

(2) From Bad/Poor Good: If you could increase your score by 71 points, your interest rate would be cut by 67%, saving you almost $6700 over the life of the loan.

(3) From Good to Excellent: If you already have good credit, raising your score by 60 points could mean that you qualify for a 0% loan, which means you pay no interest at all.

Finding a Solution to Raising Your Credit Score

If you are going to buy a car, it’s highly likely that you will need to qualify for a loan. In addition to just qualifying for any loan, you also want to get the best interest rate possible. That can be tough if you are a renter and don’t have the positive impact of a history of home mortgage payments as a positive tradeline on your credit report.

RentReporters wants to change that by helping renters benefit from the good financial behavior they have been demonstrating for years – paying their rent on time every month. We report monthly rent payments to the credit bureaus, just like any other debt repayment such as a credit card. Demonstrating that you’re responsible and reliable with a large financial obligation, like rent, should have a positive impact on your score. And a higher score will give you access to the borrowing and financial opportunities you deserve – like getting that car you need.

You can learn more here.