Credit Education , Credit Score - 18 mins read

Financial Tips

After all…reporting your rent is just the start. We help you get serious about your finances!!

Tools

Explore all Resources Of Credit Education

College , Credit Education , Credit Score - 3 mins read

Paying Back Your Student Loans

RentReporters , Student Account Manager

College , Credit Education , Credit Score - 10 mins read

When Does it Make Sense to Refinance or Consolidate Your Student Loans?

RentReporters , Student Account Manager

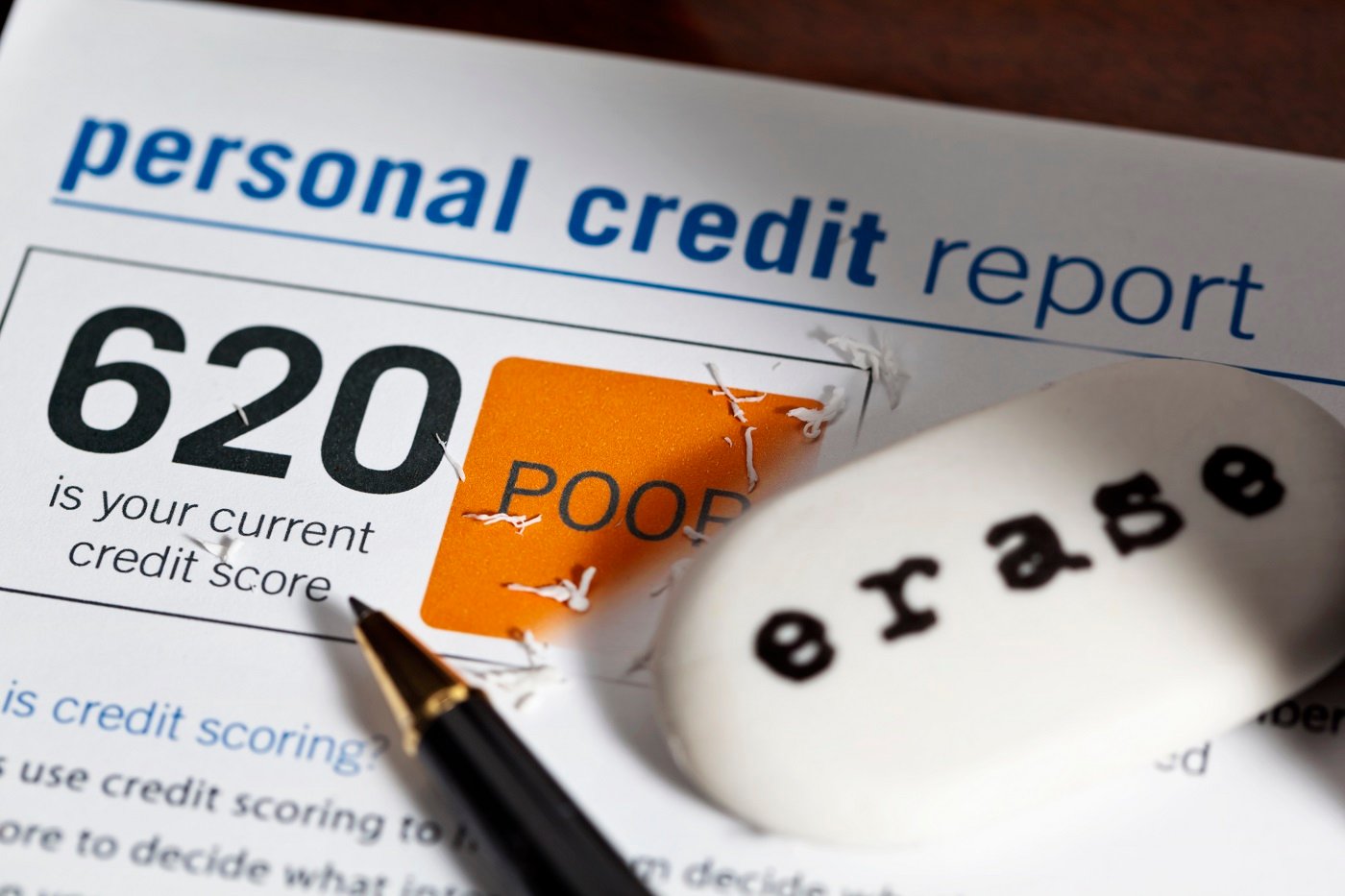

Credit Education , Credit Score - 2 mins read

3 Easy Moves That Will Boost Your Credit Score

RentReporters , Student Account Manager

College , Credit Education , Credit Score - 4 mins read

5 Ways to Build Your Credit From Scratch

RentReporters , Student Account Manager

Credit Education , Credit Score - 2 mins read

Improving Your Credit Score versus Credit Repair

RentReporters , Student Account Manager

Credit Education , Credit Report - 3 mins read