The FICO Resilience Index – What You Need to Know

Credit EducationRentReporters

August 5, 2020

5 mins read

The FICO Resilience Index is a new credit rating that, while it has been in the making for many years, was recently released due to the economic downturn caused by COVID-19. This newest FICO index was created to help lenders better measure a person’s ability to keep their financial obligations in times of economic uncertainty.

Most lenders will look at the FICO Resilience Index in combination with other credit scores such as the Vantage and traditional FICO score, as it gives them more information to better assess an individual’s financial resiliency — that is, it provides a more complete picture of a person’s ability to stay current with their loans, particularly in times of financial difficulty.

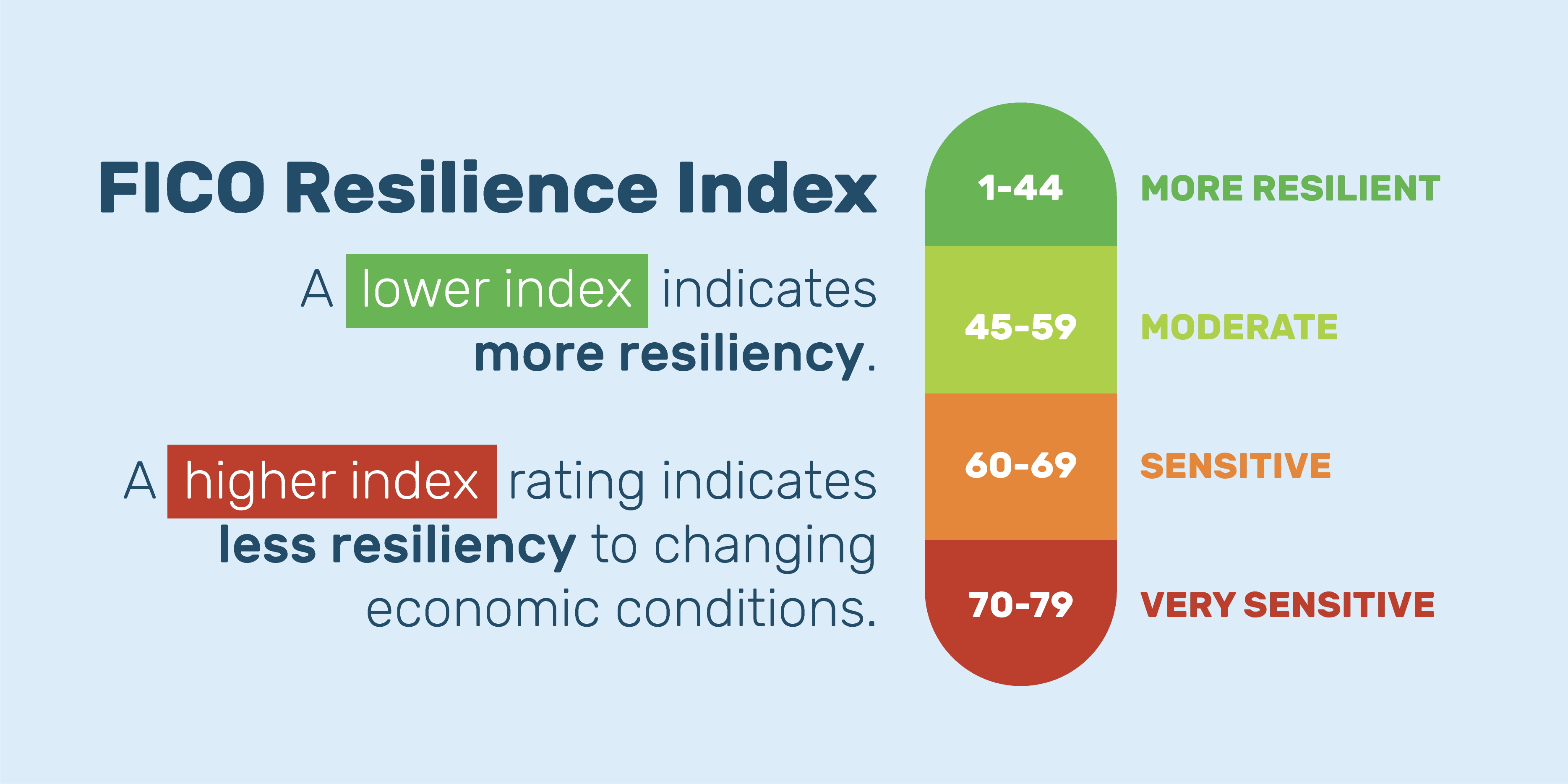

The FICO Resilience Index operates on a scale of 1 to 99, with lower scores indicating greater financial resilience in an economic downturn. FICO calculates the score using the same data contained in credit reports; however, it puts a greater focus on how much people use their available credit and what their overall credit balances are, and is less focused on payment history.

There are pros and cons to this newest index. Because of its focus on how much credit people use rather than payment history, people who may have seen their traditional credit score drop as a result of missed payments can benefit from the FICO Resilience Index. The Washington Post summarizes the new index this way:

“Consumers with an exceptional resilience index tend to have longer credit histories, fewer active accounts and less-frequent credit inquiries, and also have lower revolving credit card balances.” In other words, people may pay their bills on time every month — but if they also max out their credit cards they’re less likely to be resilient in a downturn.

As an example, the article looks at two consumers who each have a FICO score of 680 — a decent score. If one consumer uses about 70 percent of their available credit and the second consumer only uses about 10 percent, the second person would get a much better resilience index score and potentially be a better person to lend to.

While the new Resilience Index can give people with average or below-average credit scores a leg-up in finding a good-value loan, there is a downside to the index as well. Credit card issuers have been reducing available credit card lines for customers, which is standard practice in an economic downturn. But it also means that consumers can suddenly find they have used a larger percentage of their available credit line, which can result in a higher Resilience Index score, which is not desirable. In this way, the index can make it more difficult for some consumers to have access to the best credit products and cause those most at risk to turn to predatory lending products, such as pay-day loans (see our last blog post about this topic).

The best approach to getting a good resilience rating is to make sure you’re not over-relying on credit cards to pay for expenses — which is good for your financial wellness anyway. If you are having trouble making ends meet there are many resources available to you, including recent posts on this blog.

RentReporters is here to help you keep your credit in good standing by working with your landlord to report your rent payment activity. While it may not have a direct impact on the FICO Resilience Index score, it will help your other credit scores which are still taken in account. Find out more at https://www.rentreporters.com/price/.