News: Credit Reports to Exclude Certain Negative Information, Boosting FICO Scores

News and Press ReleaseRentReporters

March 15, 2017

7 mins read

Changes could improve credit scores for millions of consumers, may pose risks for lenders

By AnnaMaria Andriotis via Wall Street Journal

One in five consumers has an error in at least one of their three major credit reports, according to a 2013 Federal Trade Commission study mandated by Congress. The three credit bureaus received around eight million requests disputing information on credit reports in 2011, according to the CFPB.

In 2015, the credit-reporting firms reached a settlement with New York’s attorney general over several practices, including how they handle errors. This was followed by one with another 31 states. One more state, Mississippi, followed last year.

The state settlements already had prompted the credit-reporting firms to remove several negative data sets from reports. These included non-loan related items that were sent to collections firms, such as gym memberships, library fines and traffic tickets. The firms also will have to remove medical-debt collections that have been paid by a patient’s insurance company from credit reports by 2018.

Such changes might help borrowers and could spur additional lending, possibly boosting economic activity. But it could potentially increase risks for lenders who might not be able to accurately assess borrowers’ default risk.

Consumers with liens or judgments are twice as likely to default on loan payments, according to LexisNexis Risk Solutions, a unit of RELX Group that supplies public-record information to the big three credit bureaus and lenders.

“It’s going to make someone who has poor credit look better than they should,” said John Ulzheimer, a credit specialist and former manager at Experian and credit-score creator FICO. “Just because the lien or judgment information has been removed and someone’s score has improved doesn’t mean they’ll magically become a better credit risk.”

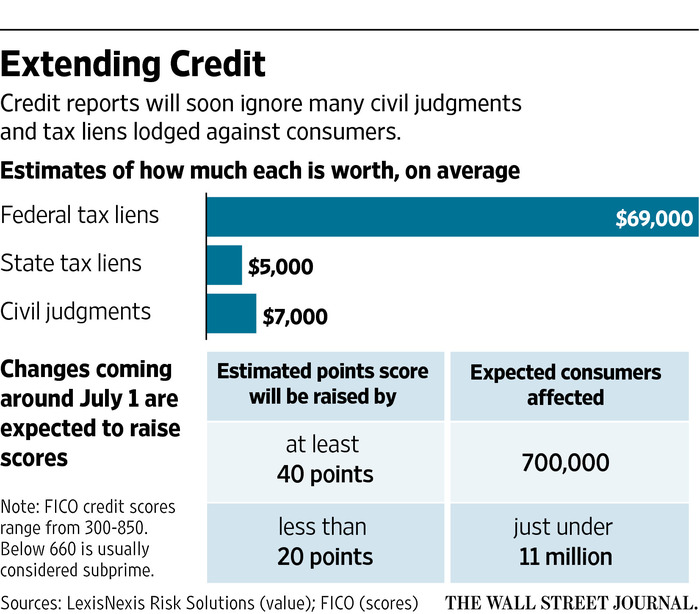

Removing this information from credit reports also will lead to changes in people’s credit scores. Roughly 12 million U.S. consumers, or about 6% of the total U.S. population that has FICO credit scores, will see increases in those scores as a result of this change, according to the company that created the FICO system, which is used by lenders in most U.S. consumer underwriting decisions.

For most of these consumers, the score increase will be relatively modest. FICO projects that just under 11 million people will experience a score improvement of less than 20 points. FICO scores range from 300 to 850. The higher the score, the more creditworthy a consumer generally is.

Scores are projected to rise by at least 40 points for around 700,000 consumers, according to FICO. In many cases, that can mean the difference between getting approved for credit or denied it.

Civil judgments include cases in which collection firms take borrowers to court over an unpaid debt. Ankush Tewari, senior director of credit-risk assessment at LexisNexis Risk Solutions, says that nearly all judgments will be removed and about half of tax liens will be removed from credit reports as a result of the changed approach. He says LexisNexis will continue to offer the data directly to lenders.

In addition, if public court records aren’t checked for updates on lien and judgment information at least every 90 days, they will have to be removed from credit reports.

Lenders will still be able to check public records on their own to find this information.

Click here to view the original Wall Street Journal Article.