What if You Could…Take Control of Your Financial Life?

Credit Education , LandlordsRentReporters

November 16, 2016

3 mins read

Credit is important. It’s what enables you to gain access to financial products so that you can get what you need in life.

Do you ever plan on buying a house? Have you financed a car yet? People typically borrow money or finance so that they can have the American dream. And to be approved for financing, you need a credit score. Lenders need to see that you are able and willing to pay back borrowed money.

Credit is important. It’s what enables you to gain access to financial products so that you can get what you need in life. And by establishing a credit score for the first time or improving an existing score, you gain access to those credit products that can reduce the cost of borrowing, possibly saving you thousands of dollars each year!

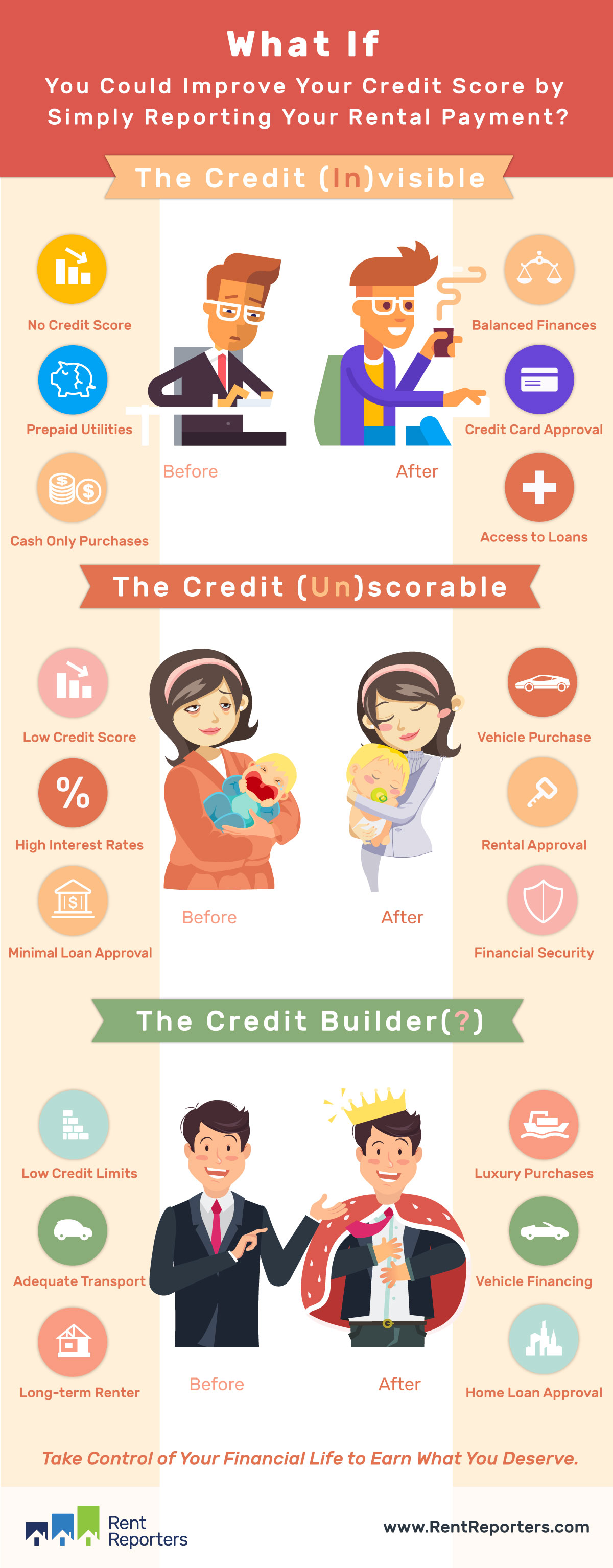

But what if you’re like the millions of Americans who don’t have a credit score? Or, what if you have a credit score, but you want to improve it so that you can accomplish something, like buying a home, renting a better apartment, or being approved for an auto loan?

Chances are you or someone you know falls into one of these categories – the credit invisible, credit scorable, and those who have a credit score but want to improve it. And what’s frustrating is that you’re paying your bills on time, like your monthly rental payments. But your responsible financial behavior isn’t being added to your credit file because it’s not being reported to the nationwide credit reporting agencies. That’s just wrong.

With RentReporters, you can change that. RentReporters reports your monthly on-time rental payments to TransUnion. By having your rental payments reported to one of the nationwide credit reporting agencies, you can start building and improving your credit score.

Imagine the possibilities. Take control of your financial life.