Why I Joined RentReporters:

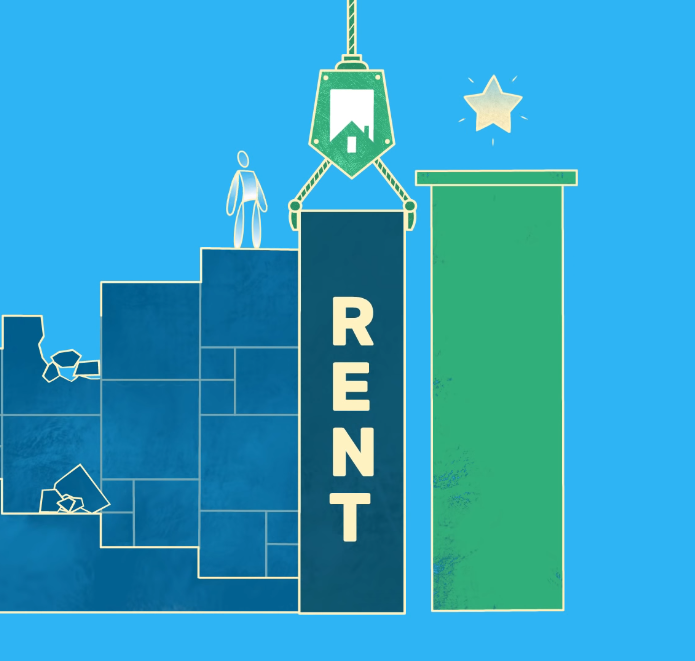

I found myself unemployed, and as a result, I fell behind on my mortgage payments. I tried different loan modifications to keep my home, but that only made my situation worse, as my credit score plummeted due to all the hard credit inquiries. When it was all said and done, my credit score went down to 485!

I wound up selling my home and had to start over to rebuild my credit. I began my credit journey by focusing on paying my bills on time, but my efforts were not having a great impact on my score. And as time went on, my low credit score continued to affect my life in a negative way. For example, when searching for an apartment to rent, I was turned away because of my credit score. I also needed a new car, as my old car was breaking down, but I wasn’t able to purchase one since I was denied an auto loan. My score stopped me from getting anything I needed.

I decided to do some additional research, and in the process, read about RentReporters while looking online. Before that, I didn’t know that my rent payments could be reported to increase my credit score. Even my real estate agent didn’t know about reporting rent payments.

I signed up in August 2016, and my score went up in about a month. Today, my score is now in the high 600s!

After Joining RentReporters:

I continue to check my credit score like I do my bank account, and I am always educating myself by reading articles about credit and what I can do to continue to improve my credit score.

With my improved credit score, life has changed in many positive ways. I was approved for a credit card. Recently, I even got another new credit card in the mail – and I didn’t even apply for it! I was also approved for an auto loan. I’m looking to open a new business and would like to be a homeowner again – all that is now possible with my improved credit score.

My Experience with RentReporters:

The RentReporters team answered my questions, and they did what they said they would do, report my on-time rent payments, and as a result, my credit score increased. I have already recommended RentReporters to others, and will continue to recommend them to anyone who is looking to increase their credit score.